SECTION 4: THE NOTARIAL CERTIFICATE

A Notary Signing Agent will consistently deal with the most common loan documents. There are two main notarial acts that are performed when the Notary Public is witnessing a signature. Each document package will contain notarial certificates - acknowledgments, jurats, affidavits, etc. Loan documents can contain any facet of notarial certificate; however, the most commonly used certificates are acknowledgments and jurats. You probably already have some familiarity with these forms, but we're going to take a few minutes to go over them again, more specifically with regard to the duties of an NSA.

The Notary can take an acknowledgment from the signer or can administer an oath (affirmation) to the signer. It is very important to understand the difference between the two and the rules that govern both. During the loan signing, the Notary Signing Agent will be asked to perform both many times during one appointment.

A Notary Public must use every precaution expected of a person of ordinary prudence and intelligence to exercise reasonable care when performing notarial acts. The National Notary Association points out 14 steps to proper notarization to assist Notaries Public in avoiding the most common pitfalls:

- Require every signer to personally appear;

- Make a careful identification;

- Feel certain the signer is aware;

- Check the signature;

- Look for blank spaces;

- Scan the document;

- Check the document's date;

- Keep a journal of notarial acts;

- Complete the journal entry first;

- Make sure the document has notarial wording;

- Be attentive to details;

- Affix your signature and seal properly;

- Protect loose certificates; and

- Don't give advice.

Throughout this course, we will elaborate on each key item above.

The Signature

It is not enough to have the borrower sign the document where appropriate – the borrower's signature must be signed exactly as it appears on the documents.

You may get a signer who doesn't typically use his or her first name and therefore, doesn't even think about signing it. The borrower's "automatic" signature may be just the initial of the person's first or middle name combined with the last name, such as:

![]()

However these documents are legal documents and therefore require the borrower's first name. If the documents are written in the name of Jane R. Doe, for instance, the borrower's signature must reflect Jane R. Doe:

![]()

Just because she doesn't go by the name of Jane – all her friends call her by her middle name, Rita – doesn't mean she can vary her signature on the documents.

During the signing process there will be occasions where initials only are used. The same holds true with the initials as the person's name. Rita must initial using the same initials that are stipulated in the document – in this case:

![]()

So what happens if the name is wrong on the documentation? You get to the closing and the borrower's name is listed as Jane A. Doe and Jane informs you that her middle initial is R and her proof of identity supports that fact. Then you must call the company for instructions. Some companies will have the borrower cross out the incorrect initial everywhere it appears and handwrite in the correction – and initial the changes using all three initials of the person's name.

Be sure you follow the company's instructions.

The Acknowledgment (ACK)

In an acknowledgment, the Notary certifies to having positively identified the document signer(s) who personally appeared and stated that he/she understands the document and has signed the document of their own free will before the Notary. If there is any question about the signer's willingness to execute the document or his/her understanding of the contents of the document, the notarization must not be performed.

The acknowledgment is the most commonly used form of notarial act. A document that requires an acknowledgment contains a prepared notarial certificate that contains the word "acknowledged."

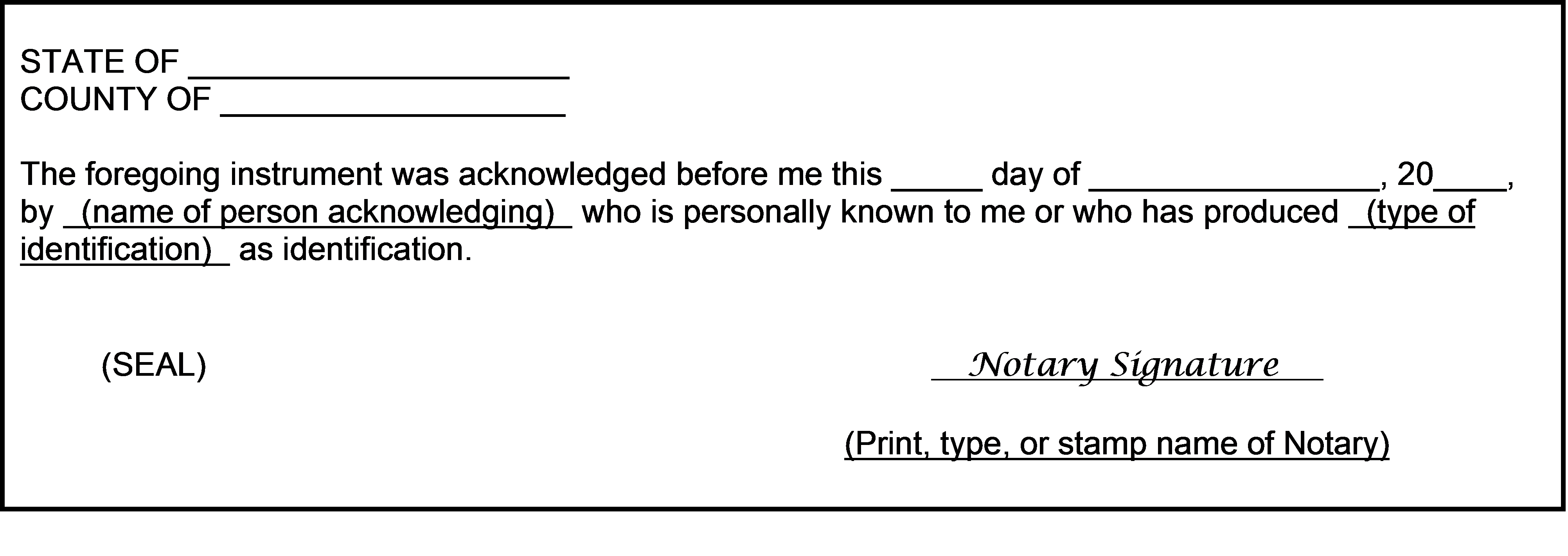

Deeds, mortgages, contracts and powers of attorney generally require an acknowledgment. Following is a typical example of an Acknowledgment:

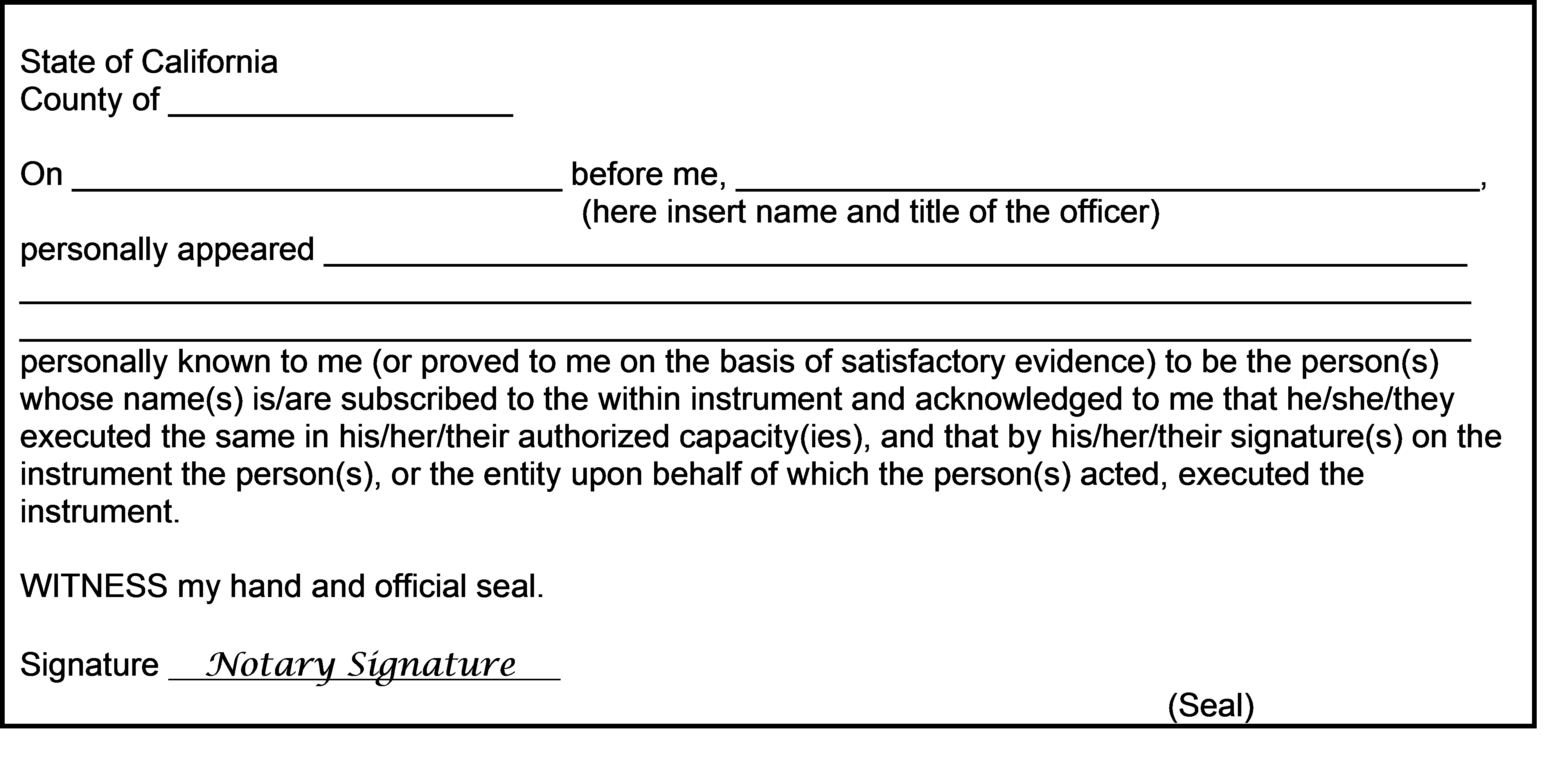

Several states are now making it mandatory that certificates of acknowledgment be in an exact form; and deviations from that form will no longer be permitted, such as the following example from the State of California (effective January 1, 2006).

Note: The document's date on an acknowledgment should either precede the date of the actual notarization or be the same as the date of the notarization, but should never be AFTER the actual date of notarization.

The Jurat

The second most frequently performed notarial act is the jurat. The jurat can be easily identified through the inclusion of the words, "subscribed and sworn to" (or "affirmed") on the certificate. A jurat is performed when the borrower declares under oath (or affirmation) that the statements made in the document are true. The signer personally appears before the Notary to swear to the Notary that the information contained in the document is true. A person who makes a false oath or affirmation is subject to criminal charges of perjury.

The law states that there must be a verbal exchange between the Notary and the document signer in which the signer indicates that he/she is taking an oath. The Notary should ask the signer, "Do you swear [or affirm] that the information contained in this document is true?" The Notary must be certain that the signer has verbally answered, "I do" or "Yes" – any other verbalization or a shake of the head or nod is not sufficient.

Affidavits and depositions generally require an oath (jurat), rather than an acknowledgment. However, the following required steps are the same:

- The signer must personally appear;

- The signer must be positively identified; and

- The document must be properly scanned.

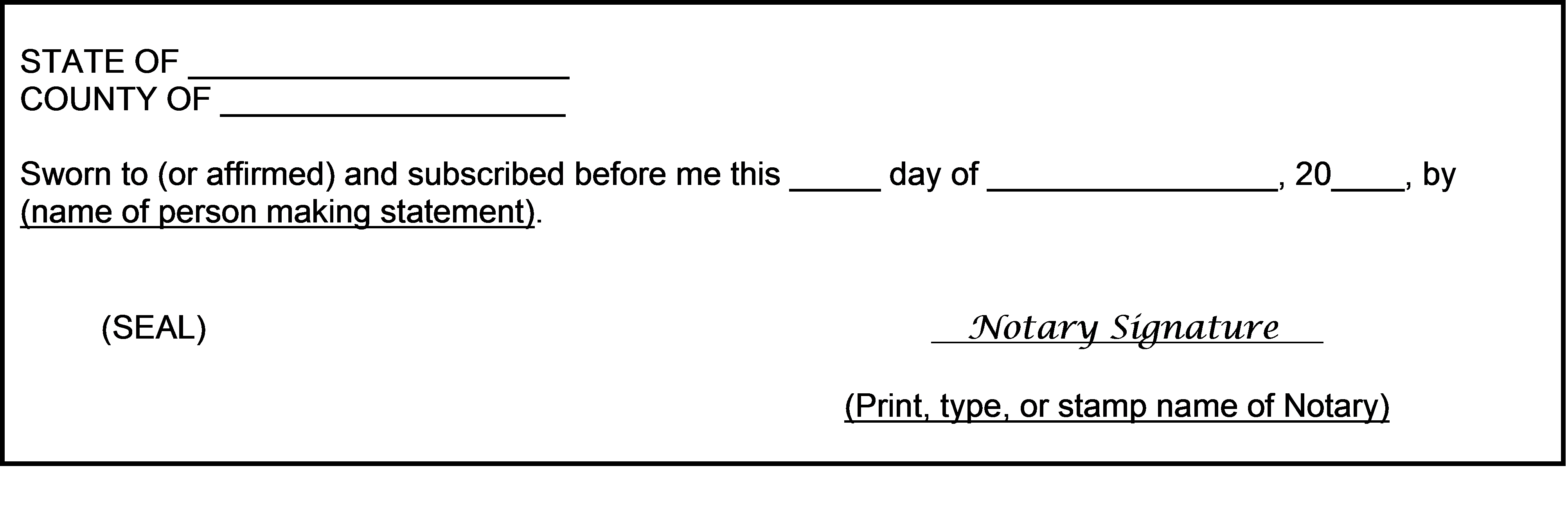

Following is a typical example of a Jurat.

Note: The document's date on a jurat must match the actual date of notarization.

Affidavits

Affidavits are a form of sworn written and signed statement commonly used in formal court proceedings. Affidavits such as the following are typical examples of loan documents that require a jurat:

- A Signature/Name Affidavit, wherein the borrower discloses any other names or aliases he or she is or has been known by;

- An Occupancy Affidavit, wherein the borrower states that he or she is going to physically occupy the property being purchased; and

- A Mortgagor's Affidavit, wherein the lending agency guarantees or insures the loan.

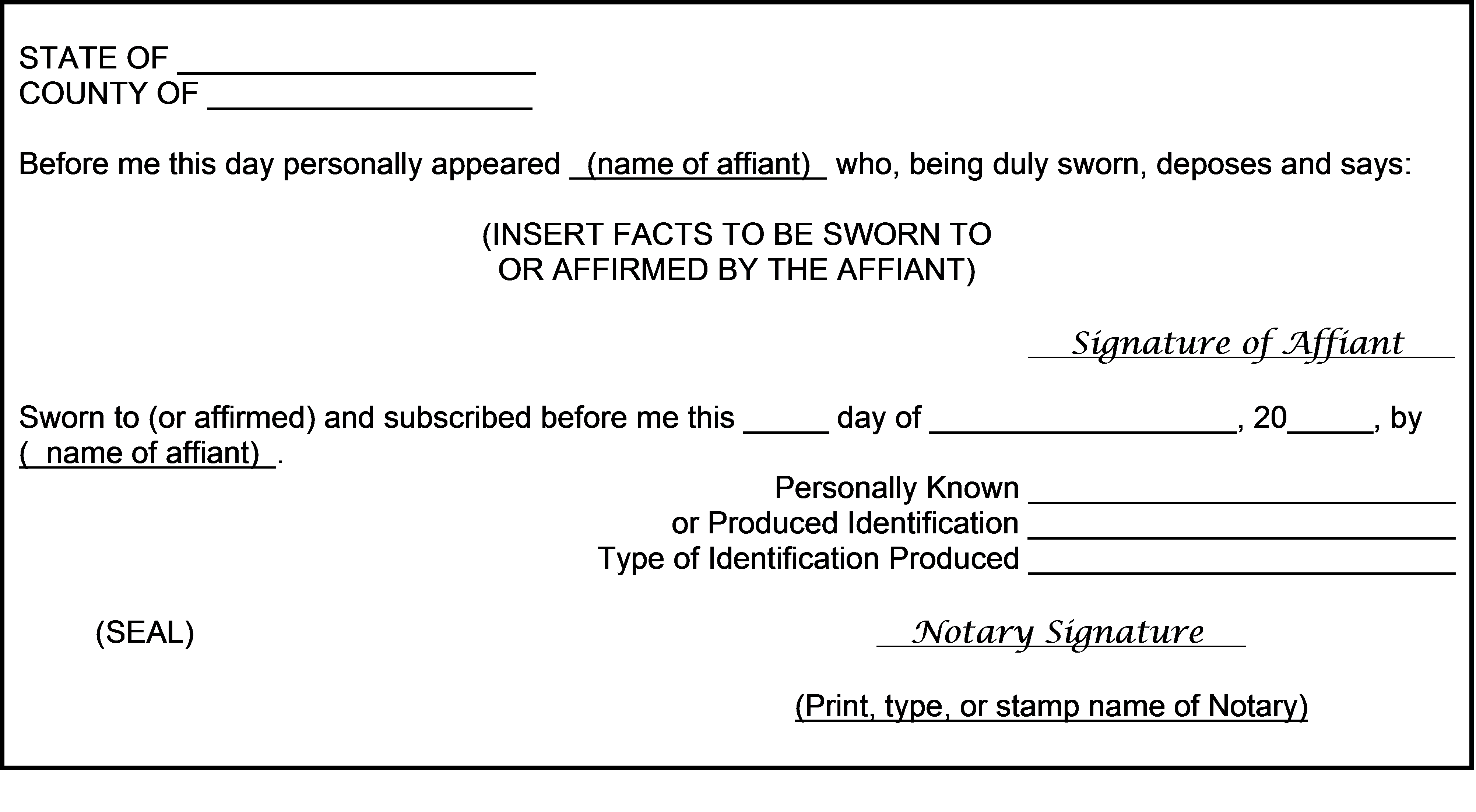

Following is an example of a jurat used as an affidavit: