SECTION 3: CLIENT BASE

As briefly discussed in the preceding section, there are basically two types of clients from which the Notary Signing Agent draws business:

- Directly contracting with lending institutions, title and escrow companies; and

- Becoming affiliated with a signing service (SS).

There are many ways in which to market your business – but always keep your target audience in mind. Let's go over the differences between these two potential customers, exploring the advantages and disadvantages of each.

Lending Institutions

As we've already mentioned, lending institutions tend to pay higher rates than signing services. This is definitely an advantage. However, in order to work directly with lenders, title companies, mortgage brokers, banks, and savings and loan institutions, you must market yourself - whereas signing services have already done the marketing for you.

When you contract directly, you will be able to perform more personalized services as you learn how to execute signings according to the specifications of your particular clients; and you will be able to interact personally to develop a strong relationship with those clients. A plus in getting to know and deal with escrow officers directly is that you may be able to access their advice should a conflict arise during a closing after hours. A drawback, however, is that title companies are less likely to tolerate mistakes than signing services.

Another advantage of contracting directly is that you may be able to provide your direct clients with a copy of your appointment schedule so they will be aware of your availability and, as you prove yourself to be a trusted and reliable associate, you will receive more appointments. As they come to know and trust your work, some lenders will make attempts to accommodate your schedule.

However, another drawback to working directly with lending institutions and title companies is that you only get paid IF the transaction is completed. If the borrower exercises the right to cancel the transaction (Right of Rescission), even after the loan document signing, the Notary Signing Agent will not get paid.

Signing Services

Signing services are companies that actually acquire the work and dispatch Notary Signing Agents on an as-needed basis. A signing service will have many notaries at their disposal, so they can fulfill their clients' needs on a regular basis. A signing service acts as a middleman between those who require Notary Signing Agent services (lenders and title companies) and those who supply Notary Signing Agent (NSA) services (you). As a go-between, the signing service must make money as well. Therefore, when a Signing Agent contracts with a signing service, the rate of pay is less than what the Notary could receive in dealing directly with lenders and title companies. Signing services generally pay the notaries they use between $50 and $60 per signing. However, for this trade-off in pay, the signing agency can provide notaries with a higher volume of signings since the agency has already done the legwork.

When the lender has a closing, they will typically fax the order request to the signing service. The service will then confirm the time and details with the lender and then schedule an NSA to perform the closing.

Signing services can be a valuable tool for the new NSA to gather experience. Lending institutions will not generally be enthusiastic about hiring an inexperienced NSA as an independent contractor for their loan closings. Signing services can provide the novice NSA with a steady volume of assignments which will expedite the Notary's level of experience.

If you decide to use a signing service, make sure you check the service out completely. Get a report from the Better Business Bureau. Since you will be affiliating yourself directly with a company, make sure the company you represent is worthy of your services. If the company you are considering representing does not have a good reputation in the industry, you don't want your name affiliated with them.

A list of mortgage brokers and lenders who adhere to ethical sales practices is being developed by consumer watchdog services to assist Notary Signing Agents find reputable sources for assignments. This list is scheduled to be available in August 2006 and can be accessed at www.homeownersconsumercenter.com.

One of the positives to working with a signing service is that you will still get paid even if the borrower exercises the right to cancel the transaction (Right of Rescission). A plus when working with a reputable signing service is that payment on a regular basis for the work you've done is guaranteed. You know when they pay their invoices so you know when to expect payment.

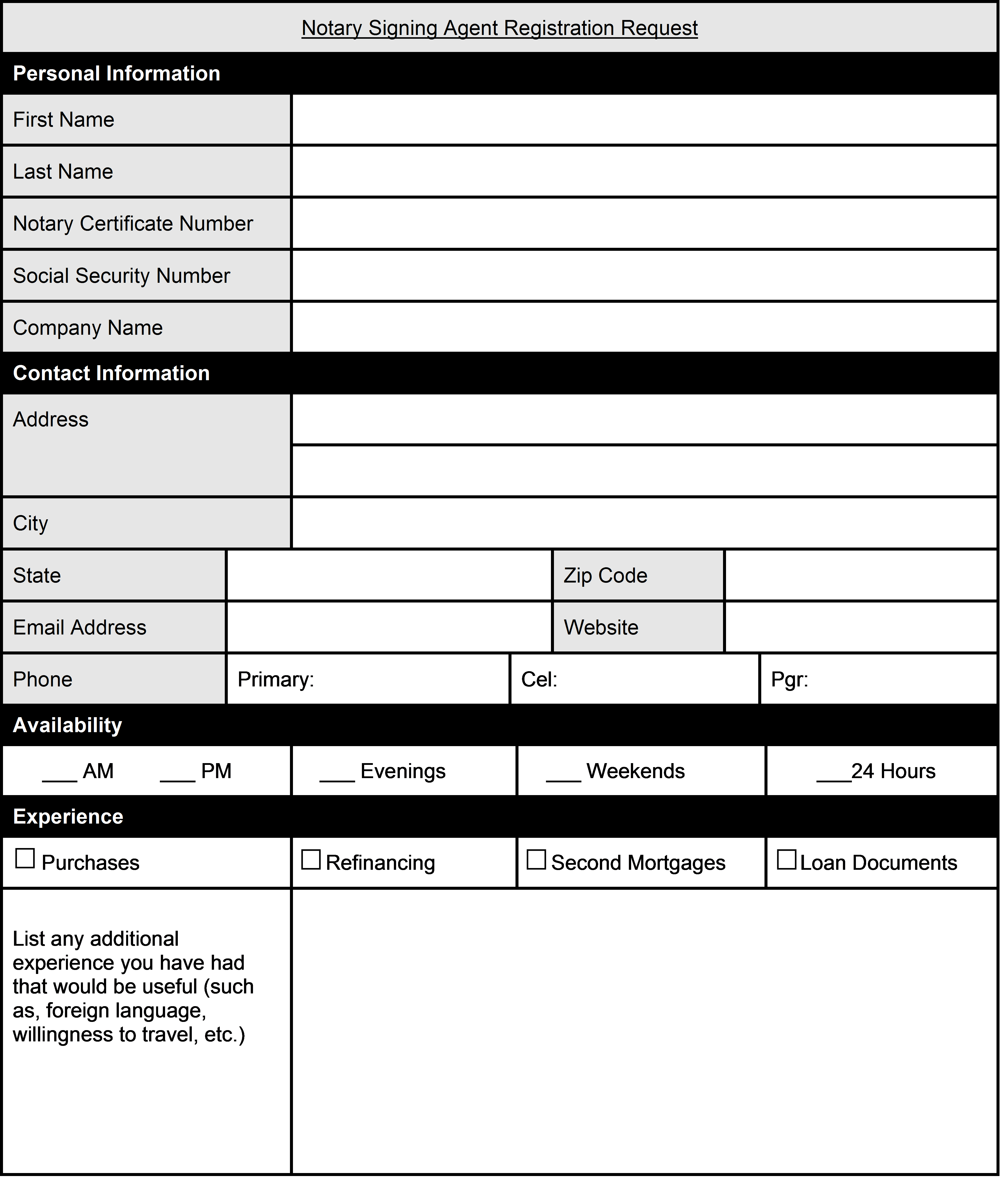

Signing Service Application

Signing services maintain a database of NSAs who they have recruited through their own assessment programs. When you contact a signing service, they will require you to complete an application. After all, they want to make sure you are worthy of being affiliated with them as well. Many signing services advertise online and provide online applications as the first point of contact. An application, or registration form as some call it, will typically ask for basic personal information and any other information they deem appropriate in their screening processes. Most applications will ask for some type of proof of your commission, such as your notary certificate number. Some applications can be completed online and submitted while others must be printed, completed in your own handwriting and mailed or faxed to the company. Following is an example application.

Once the signing service receives your submitted application and your information is accepted as a "potential NSA" for them, a representative will contact you and will probably request additional information, such as any of the following:

- Driver's license information (they may ask for a photocopy);

- Completion of a W-9 form;

- Proof of Notary credentials (surety bond, E&O); and/or

- Automobile insurance information.

Once you have submitted applications to signing services, make sure you have any additional pertinent information they may request available at your fingertips. This shows them that you are organized and efficient. It does not leave a good impression if they have to wait on the phone while you "hunt" around looking for the additional information they have requested. Be prepared to demonstrate that you are organized and efficient and ready to work.

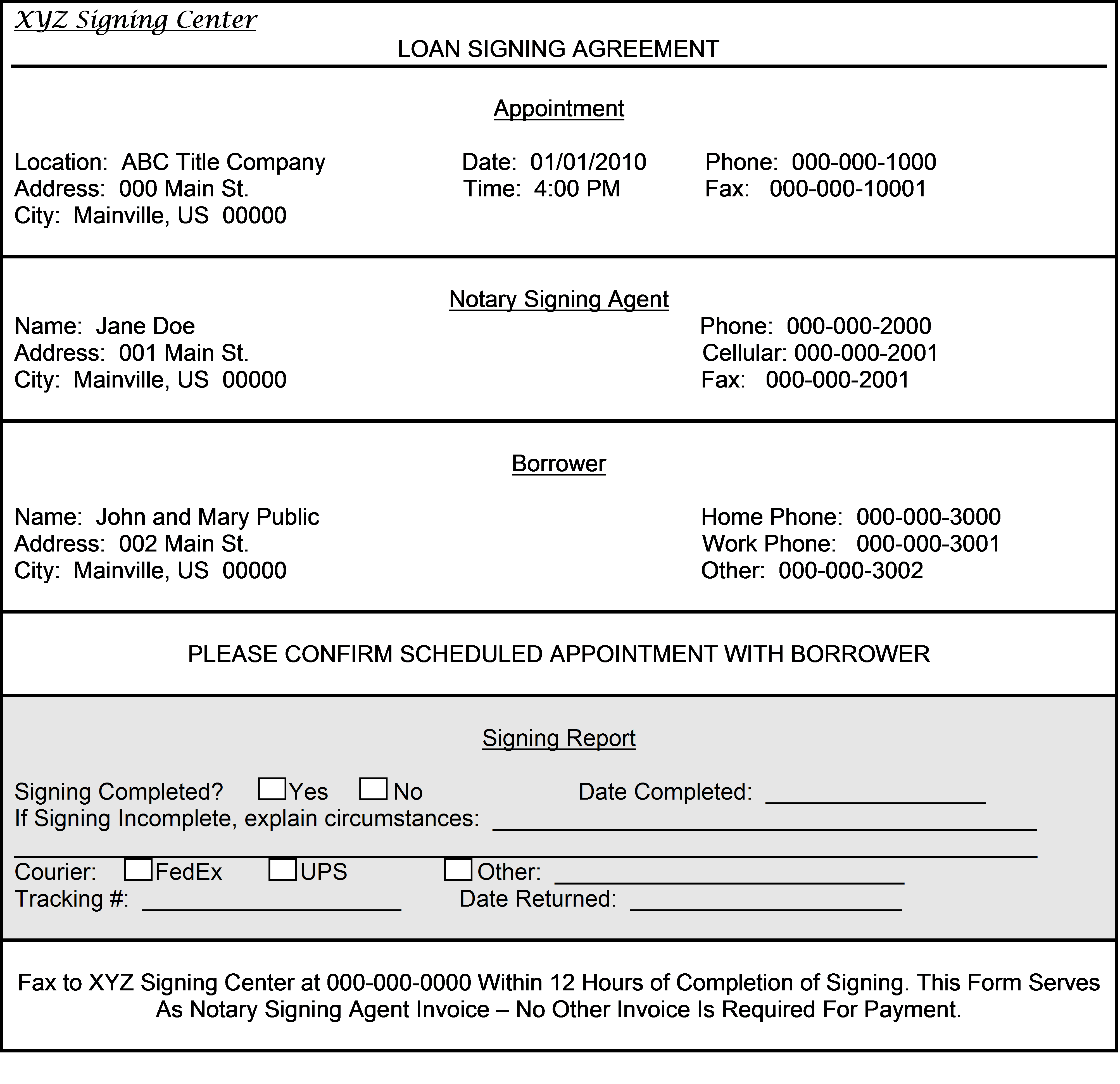

Loan Signing Assignment Form

If the NSA is appointed through a signing service, the company will send the Signing Agent what is called a Loan Signing Assignment Form, usually by fax. Following is a sample

Independent Contractor's Agreement

As an independent contractor, the signing service may require you to sign an independent contractor's agreement. There is no "set" contract, but the majority of agreements will contain provisions outlining the following clauses:

- Independent Contractor Status - This clause acknowledges that the Notary is not an employee of the company and therefore will not receive employee benefits, that the Notary does not have set working hours but that the Notary will make him/herself reasonably available for services, and that the Notary retains the right to decline to provide requested services.

- Commencement, Continuation and Termination of Contract – The contract will typically continue for one year following the commencement date; and termination of the contract typically takes place with 30-days' prior written notice from either party to the contract. Pay attention to the anniversary date of the contract since these contracts typically self-renew. If you decide to continue your working relationship, you may be able to negotiate higher fees before the automatic renewal.

-

Fees, Expenses and Taxes – This clause points out that the Notary is responsible for his or her own expenses and for reporting and paying taxes on the income produced; and will also include a fee schedule for differing situations, such as:

- Signing appointment completed within 50 miles round trip from Notary's stated business address - $50;

- Signing appointment completed and Notary travels more than 50 miles round trip from Notary's stated business address - $60;

- Notary waits at least 30 minutes and borrower(s) do not show up for appointment - $50;

- Appointment canceled less than one hour before scheduled appointment time - $50;

- Appointment canceled one hour or more before scheduled appointment time - $0;

-

Non-Compete Clause – A non-compete clause is typically effective for one year from the date of inception of the contract; however, these clauses should be looked at very closely as the wording can be destructive to your future business.

It is typical if the contract states that you are restricted from contacting the signing service's clients directly for the purpose of performing loan signings for a period of one year after contract termination.It is not typical, however, for the contract to state that you are restricted from performing loan document signings for any other signing companies, lenders or title companies with whom you had previously worked before entering into the contract with the SS.

- Contractor Shall Not Give Legal Advice – You are not a loan officer - you are not an attorney - you are a Notary Public and, as a Notary Public, you know it is illegal for you to provide legal advice of any kind.

- Notary Commission and Indemnification – Most people have run into this type of clause before. It states, "…agrees to indemnify, defend, and hold the Company harmless from and against all claims, causes of action, losses, damages, fines, liabilities and expenses, including attorney fees arising out of or in connection with his/her performance of services pursuant to this Agreement…" further stating that "…damages shall be defined to include, but not be limited to, all damages that the Company may incur as a result of Notary's loss of loan documents."

- Performance of Notarial Acts According to State Law – It is the duty of all Notaries Public to know their state laws and adhere to them accordingly.